DMO: Another Distribution Hike For This 13.4% Yielding CEF, Though Likely Its Last

This is an extract from an earlier article at Systematic Income Premium.

In this article, we take another look at the Western Asset Mortgage Opportunity Fund (DMO) - a fund primarily allocated to residential mortgage assets. The fund just hiked its distribution once again - the third time in a row. We continue to hold a position in the fund in our High Income Portfolio.

Fund Snapshot

DMO allocates primarily to non-Agency residential mortgages. This allocation is split up into roughly three equal buckets - legacy, new-issue and CRT (see section below for a description of these).

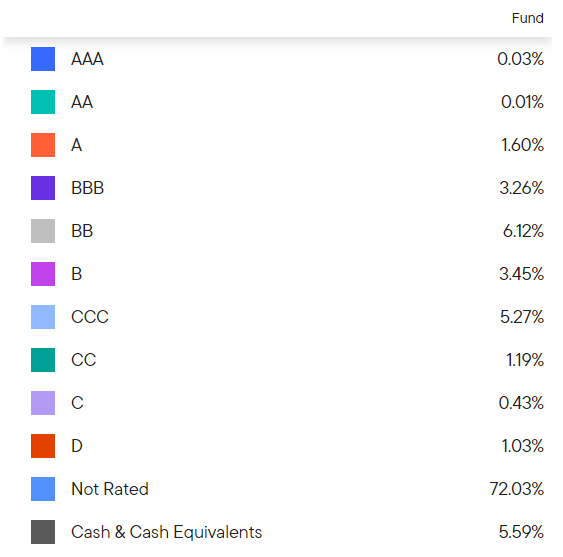

Over 70% of the portfolio does not carry ratings. This is not unusual for sub-investment-grade mortgage assets, particularly for legacy assets. The fund's NAV volatility is relatively low which suggests that its asset quality is not especially low by credit CEF standards.

RMBS Background

By way of background on the fund's portfolio, after the GFC, the US government looked for a way to derisk the business profile of its housing agencies and settled on the so-called CRT securities as a way to partially offload the household credit risk to the broader market.

The schematic below shows how CRT securities work. The basic idea is that losses from mortgage defaults flow from the bottom-up with lower / higher-yielding tranches in the CRT structure absorbing losses first while the agency retains some skin in the game across the entire structure.

The legacy non-agency RMBS set of securities, on the other hand, are those that were mostly issued prior to the GFC. This market continues to shrink as it has been largely replaced by CRTs and new-issue mortgages.

DMO holds all three types of securities with the primary focus being residential mortgages, though there is some commercial exposure as well.

Household Picture

The bulk of risk in the DMO portfolio is linked to households. This aspect of the fund is an attractive one for two main reasons. First, most of the income market is linked to corporate credit risk so having another kind of risk in the portfolio allows investors to diversify their ultimate sources of returns.

And two, households are in fairly decent economic shape so far, even if some leading indicators such as consumer confidence and retail sales have turned lower. For instance, household financial obligations as a percentage of disposable income is not far off a historically low level. Much of this is underpinned by the fact that many households were able to refinance their mortgages at very low rates.

The labor market remains a key support of household financial health. Although job openings have moderated, they remain well above the pre-COVID trend. The number of unemployed per job opening remains below 1x.

House prices have come off recently due to high mortgage rates however they remain well above their pre-COVID levels. This has supported equity in housing which lowers the risk of the underlying mortgages.

Fund Update

The fund's net income profile has risen steadily since 2021 when short-term rates were at rock bottom levels. The chart below annualizes the first six months of 2023 which should come in at an even higher figure given the lag with which short-term rates translate to net income.

This is largely a function of a significant amount of floating-rate holdings - at around 80%, net of inverse floaters.

The fund's leverage profile has been very steady, meaning it hasn't lost any net income from deleveraging, unlike many other credit funds.

DMO has recently raised its distribution once again - the third time this year - which now stands 20% above its 2023 starting point. To be fair, its distribution coverage is likely to be below 100%. However this has not stopped the fund from raising the distribution in response to rising net income. In short, coverage being below 100% is not something that is likely to cause the fund to cut the distribution.

DMO has outperformed other Multi-sector credit CEFs over the last 1-3 years in both total price and total NAV returns. This is partly owed to its relatively modest duration profile, resilient underlying asset class exposure and high yield.

Its valuation has rallied somewhat over the last few months, both in absolute terms as the discount has tightened as well as relative to other Multi-sector CEFs. However, it remains wider than the sector average.

DMO has continued to repurchase its shares, having bought back 13,982 shares in Q2 of this year (82k shares since inception). This is not only accretive to the NAV but also supportive of the share price. It also shows that management is willing to cut fees in order to deliver value to shareholders.

Overall, DMO remains an attractive CEF given its ability to diversify income portfolios, attractive valuation and resilient underlying assets. That said, investors need to consider the likely direction of the Fed policy rate and its likely impact on the fund's net income profile.

At the moment, the 3-month / 5-year Treasury yield curve is inverted by more than 1% (i.e. floating-rate assets offer a yield of more than 1% above that of corporate bonds, all else equal) which offers a decent margin of safety to keep a sizable floating-rate allocation in income portfolios.

Check out more in-depth and timely commentary as well as Income Portfolios and interactive Investor Tools at our Premium service.

ADS Analytics LLC / Systematic Income provides opinions regarding securities and other related topics on an impersonal basis; therefore no consideration is made towards your individual financial circumstances.

All content presented here is not to be regarded as investment advice or constitute a client / advisor relationship. It is for general informational purpose only.

Trading securities involves risk, so you must always use your own best judgment when trading securities. You assume the entire cost and risk of any trading you choose to undertake. You are completely responsible for making any investment decisions.