Blue Owl Capital Corporation III: Adding A Starter Position In This 10.9%-Yielding BDC

This is an extract from an earlier article at Systematic Income Premium.

A couple of months ago, we published an introductory article on the recently IPO'd BDC Blue Owl Capital Corporation III (OBDE). This article is a quicker-than-usual update for two main reasons. One, we have more information now that Q1 earnings are out. And two, we recently added a position in the stock in our Income Portfolios, the reasons for which we discuss below.

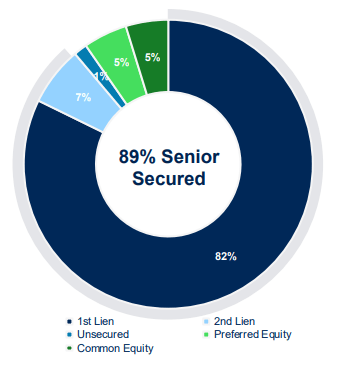

OBDE has a portfolio allocation that is fairly typical of the sector, with an 89% senior secured portfolio.

Its industry focus is in Tech, Insurance, and Healthcare - also fairly typical non-cyclical sector overweights.

By virtue of its large portfolio size, the company is focused on the upper middle market, similar to its sister BDC OBDC as well as other larger BDCs like OCSL, ARCC, and others.

Quarter Update

Net investment income came in at $0.39 - a sharp fall from the previous $0.58 level, despite growth in total investment income. In our last update, we warned to expect a drop in net income due to the change in the fee structure however there were additional expense headwinds, though these were largely due to one-off or timing factors.

Specifically, a quarter of the $0.19 drop in net investment income was due to the one-off exchange listing fee. Without this fee, net investment income would have been $0.44, resulting in an NAV yield of 11.3% and total dividend coverage of 107.5%.

The company declared a $0.35 base dividend, unchanged from the previous quarter, as well as a $0.06 special dividend. There will be a total of 5 $0.06 special dividends paid to start in June (record date as of 31 May). This works out to a total dividend yield on NAV of 10.5%. Special dividends are fairly common for BDCs like OBDE with lock-up expiries and are intended to increase demand and support the stock price.

The NAV rose by 0.6%, due to the combination of retained income and unrealized appreciation.

This is the 7th quarterly gain in the NAV.

The path forward for the NAV depends as much on the company's portfolio performance as on its dividend. Because its fees will increase, we expect dividends to remain below their pre-IPO levels, with coverage above 100%.

Once its 5 special dividends are out of the way, it's likely that OBDE will adopt the same supplemental dividend framework as OBDC which pays out half the excess net investment income above the base dividend. If that's correct, then the NAV should get some support over time through retained income.

Overall, the company delivered a 2.9% total NAV return for the quarter, slightly below the average in our coverage. Without the one-off exchange listing fee, it would have outperformed.

Income Dynamics

Net investment activity was very robust with a total of $400m of net fundings or about 10% of the outstanding portfolio.

This activity pushed leverage from one of the lowest to about the average level in the sector.

Asset yield fell by 0.4% to 11.7% while interest expense increased by 0.1%, slightly squeezing its net yield.

The drop in asset yield is likely due to a nearly exclusive focus on first-lien investments over the last two quarters.

The increase in interest expense was a simple outcome of the increase in leverage as additional cash has to come primarily from the secured facility. Its principal outstanding grew by $300m over the quarter. Its interest rate of SOFR + 2% or roughly 7.3% is above the weighted-average interest expense.

Outside of changes in leverage and base rates, we don't expect interest expense to change a whole lot over the next year as the first refinancing is due in mid-2025.

Portfolio Quality

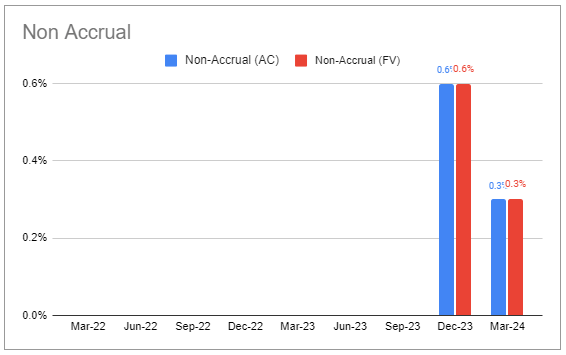

Non-accruals fell to 0.3% - one of the lowest in our coverage.

Portfolio quality, as gauged by internal risk ratings, improved slightly as there was some positive migration away from the worst-rating bucket.

There was a small net realized loss.

The first-lien allocation is at the highest level since the last quarter of 2022 and has come at the expense of the second-lien allocation. This up-in-quality trend is one we have seen across several other BDCs in the last quarter. It's also nice to see given the increasing concerns about borrower health and a likely peak in the economic cycle.

Return And Valuation Profile

OBDE has put up strong historic total NAV returns, outperforming the average BDC in our coverage. We expect this outperformance to decrease somewhat going forward given its new higher fee structure.

The company's valuation has been volatile since its IPO. The recent lock-up expiry has pushed it to an attractive level.

Recently, a valuation gap has opened up between it and its sister BDC OBDC. In our view, this creates an attractive entry point.

As of this writing, OBDE is trading at a valuation 14% below the sector average - an attractive entry point for a starter position despite some potential future volatility ahead.

Stance and Takeaways

We initiated a starter position in OBDE for three reasons. One, its historic performance is consistent with a higher valuation relative to the broader sector. Two, the valuation gap between OBDE and OBDC looks too wide in our view.

And three, while we expect potential air pockets in the stock price we think they will be contained given the very existence of its sister entity OBDC. A significantly wide valuation divergence will likely push OBDC investors to reallocate to OBDE, keeping the valuation gap relatively contained even in the presence of lock-up expiry selling pressure on OBDE.

Check out more in-depth and timely commentary as well as Income Portfolios and interactive Investor Tools at our Premium service.

ADS Analytics LLC / Systematic Income provides opinions regarding securities and other related topics on an impersonal basis; therefore no consideration is made towards your individual financial circumstances.

All content presented here is not to be regarded as investment advice or constitute a client / advisor relationship. It is for general informational purpose only.

Trading securities involves risk, so you must always use your own best judgment when trading securities. You assume the entire cost and risk of any trading you choose to undertake. You are completely responsible for making any investment decisions.